What all do you need to trade in a car? Trading in a car typically requires several key items: the car title, vehicle registration, your driver’s license, proof of insurance, any loan payoff information (if applicable), and potentially service records. Having spare keys for car trade can also be beneficial. This article provides a comprehensive checklist and details what car trade-in documents you need for a smooth process.

Image Source: content-images.carmax.com

Getting Ready to Trade In Your Car: A Thorough Checklist

Trading in your car can be a straightforward way to get credit toward your next vehicle. However, being prepared with all the required paperwork for car trade can make the process much smoother and potentially increase your trade-in value. This detailed guide provides a comprehensive car trade-in checklist to ensure you have everything you need.

The Essential Car Trade-In Documents

Before you even head to the dealership, gather these crucial documents. These are the cornerstones of any successful car trade-in.

1. Car Title: Proof of Ownership

The car title is the most important document. It proves you legally own the vehicle.

- Why It’s Important: Without the title, you can’t legally transfer ownership to the dealership.

- What to Check:

- Make sure your name is spelled correctly and matches your driver’s license.

- Ensure there are no liens listed on the title (unless you have loan payoff information, see below).

- The VIN (Vehicle Identification Number) on the title should match the VIN on the car’s dashboard and doorjamb.

- What If You Can’t Find It?

- Contact your local Department of Motor Vehicles (DMV) immediately. They can guide you through the process of obtaining a duplicate title. This can take time, so start early.

2. Vehicle Registration: Showing Current Status

Your vehicle registration proves that the car is currently registered with the state.

- Why It’s Important: It verifies the car is legally allowed on the road and helps the dealership transfer the registration.

- What to Check:

- Ensure the registration is current and hasn’t expired.

- The VIN on the registration should match the VIN on the car.

- The address on the registration should be up-to-date.

- What If It’s Expired?

- Renew it before going to the dealership. An expired registration can complicate the trade-in process.

3. Driver’s License: Your Identification

A valid driver’s license is necessary for identification purposes.

- Why It’s Important: The dealership needs to verify your identity and ensure you’re authorized to trade in the vehicle.

- What to Check:

- Make sure your license is valid and hasn’t expired.

- The name and address on your license should be current.

- What If It’s Expired?

- Renew your license before attempting to trade in your car.

4. Proof of Insurance: Demonstrating Coverage

Proof of insurance shows that the vehicle is currently insured.

- Why It’s Important: While not always strictly required for a trade-in, it’s a good idea to bring it. It verifies that you have been operating the vehicle legally.

- What to Check:

- Ensure the insurance policy is active and hasn’t been canceled.

- The name on the insurance policy should match your driver’s license.

- What If You Don’t Have It?

- Contact your insurance company to obtain a copy of your insurance card or a proof of insurance letter.

Handling Loan Payoffs: If You Still Owe Money

If you have an outstanding loan on your car, the trade-in process involves additional steps and information.

1. Loan Payoff Information: Knowing Your Balance

Loan payoff information is crucial if you still owe money on your car.

- Why It’s Important: The dealership needs to know the exact amount required to pay off your loan to take ownership of the vehicle.

- How to Obtain It:

- Contact your lender (bank, credit union, or finance company).

- Ask for a “10-day payoff quote.” This quote is valid for a specific period (usually 10 days) and includes the principal balance, interest, and any fees required to close the loan.

- What to Provide the Dealership:

- The 10-day payoff quote from your lender.

- The lender’s name, address, phone number, and account number.

- What Happens Next?

- The dealership will typically handle paying off your loan directly. They will deduct the payoff amount from the trade-in value they offer you. If the trade-in value is less than the payoff amount, you’ll need to pay the difference (the “negative equity”).

Boosting Your Trade-In Value: Helpful Documents

While not strictly required, these documents can help increase your car’s trade-in value.

1. Service Records for Trade-In: Proving Maintenance

Service records for trade-in show that you’ve properly maintained your vehicle.

- Why They’re Important: They provide evidence of regular oil changes, tire rotations, brake replacements, and other maintenance tasks. This can increase the dealership’s confidence in the car’s condition and potentially boost its value.

- What to Include:

- Invoices from mechanics or service centers.

- Records of DIY maintenance (if applicable), with dates and descriptions of the work performed.

- How to Organize Them:

- Gather all your service records in a folder or binder.

- Organize them chronologically or by type of service.

2. Spare Keys for Car Trade: A Complete Package

Having spare keys for car trade, including key fobs, can add value.

- Why They’re Important: Replacing lost keys can be expensive for the dealership. Providing all keys shows you’ve taken good care of the vehicle.

- What to Do:

- Gather all spare keys and key fobs.

- Make sure they are in working order.

- What If You’re Missing a Key?

- Let the dealership know. They may deduct the cost of replacing the key from your trade-in value.

Other Items to Consider

Beyond the documents, there are a few other things to take care of before trading in your car.

1. Clean the Car: First Impressions Matter

A clean car makes a better impression.

- Why It’s Important: A clean interior and exterior can make your car look newer and more appealing, potentially increasing its perceived value.

- What to Do:

- Wash and wax the exterior.

- Vacuum the interior.

- Clean the windows and mirrors.

- Remove any personal belongings.

2. Remove Personal Belongings: Don’t Leave Anything Behind

Make sure to remove all personal items from the car.

- Why It’s Important: You don’t want to accidentally leave behind important documents, valuables, or sentimental items.

- What to Check:

- Glove compartment

- Center console

- Under the seats

- Trunk

- Door pockets

3. Research Trade-In Values: Know What to Expect

Before you go to the dealership, research the estimated trade-in value of your car.

- Why It’s Important: This will give you a better idea of what to expect and help you negotiate a fair price.

- How to Research:

- Use online valuation tools like Kelley Blue Book (KBB) or Edmunds.

- Enter your car’s year, make, model, mileage, and condition.

- Compare the trade-in values to the private party values.

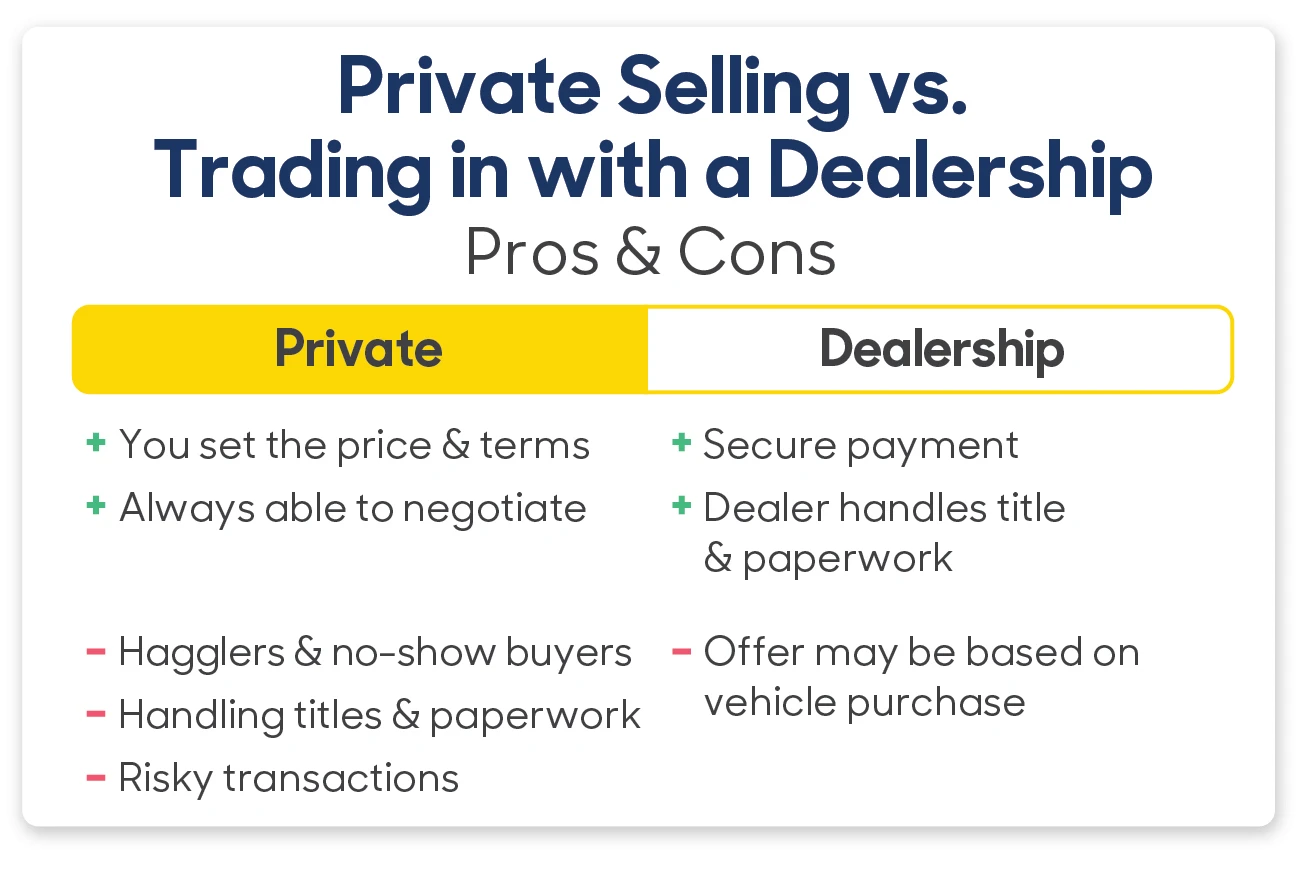

4. Be Prepared to Negotiate: Don’t Accept the First Offer

Don’t be afraid to negotiate the trade-in value.

- Why It’s Important: Dealerships often start with a low offer. Being prepared to negotiate can help you get a better price.

- Tips for Negotiating:

- Know your car’s worth.

- Be polite but firm.

- Don’t be afraid to walk away if you’re not happy with the offer.

Table: Car Trade-In Checklist

| Document/Item | Importance | Description | What to Check |

|---|---|---|---|

| Car Title | Essential | Proof of ownership | Name spelling, liens, VIN matching |

| Vehicle Registration | Essential | Proof of current registration | Expiration date, VIN matching, address |

| Driver’s License | Essential | Identification | Validity, name and address |

| Proof of Insurance | Recommended | Verification of insurance coverage | Policy status, name matching |

| Loan Payoff Information | If Applicable | Amount needed to pay off the loan | 10-day payoff quote, lender information |

| Service Records | Helpful | Evidence of regular maintenance | Invoices, DIY records, organization |

| Spare Keys | Helpful | Additional keys and key fobs | Functionality, completeness |

| Clean Car | Helpful | Clean interior and exterior | Overall appearance |

| Personal Belongings Removed | Essential | Removal of all personal items from the car | Thorough check of all compartments |

| Trade-In Value Research | Helpful | Knowledge of estimated trade-in value | Online valuation tools (KBB, Edmunds) |

Common Mistakes to Avoid

- Forgetting the Title: This is the most common mistake. Make sure you have the title before going to the dealership.

- Not Knowing Your Loan Payoff: Knowing your loan balance will help you negotiate a fair trade-in value.

- Neglecting Maintenance Records: Service records can increase your car’s value.

- Leaving Personal Items Behind: Always double-check the car before leaving the dealership.

- Accepting the First Offer: Be prepared to negotiate.

FAQ: Frequently Asked Questions

-

Can I trade in a car if I don’t have the title?

- In most cases, no. The title is essential for transferring ownership. You’ll need to obtain a duplicate title from your local DMV.

-

What if my car is worth less than what I owe on the loan?

-

This is called “negative equity.” You’ll need to pay the difference between the trade-in value and the loan payoff amount. You may be able to roll the negative equity into a new loan, but this can increase your monthly payments and overall interest paid.

-

Do I need to cancel my car insurance before trading it in?

-

Yes, you should cancel your car insurance after the trade-in is complete. Contact your insurance company to cancel your policy.

-

What happens to my license plates when I trade in my car?

-

The dealership will usually remove the license plates. You’ll need to return them to your local DMV or transfer them to your new vehicle, depending on your state’s regulations.

-

Can I trade in a car with mechanical problems?

-

Yes, you can, but the dealership will likely offer you a lower trade-in value to account for the cost of repairs. Be honest about any mechanical issues.

-

Who is responsible for the paperwork?

-

The dealership will usually handle the majority of the paperwork, but you’ll need to provide the necessary documents and information.

By following this comprehensive car trade-in checklist, you can ensure a smooth and successful trade-in experience. Being prepared with the required paperwork for car trade, including the car title, vehicle registration, driver’s license, proof of insurance, loan payoff information, service records for trade-in, and spare keys for car trade, will help you get the best possible value for your car.

Hi, I’m Luigi Smith, the voice behind carrepairmag.com. As a passionate car enthusiast with years of hands-on experience in repairing and maintaining vehicles, I created this platform to share my knowledge and expertise. My goal is to empower car owners with practical advice, tips, and step-by-step guides to keep their vehicles running smoothly. Whether you’re a seasoned mechanic or a beginner looking to learn, carrepairmag.com is your go-to source for all things car repair!