Did you know that car insurance costs can change a lot depending on where you live? Getting the right car insurance is a big deal. It keeps you safe and protects your money. But with so many companies and rules, it can be tough to know where to start, especially if you’re part of a Compliant Drivers Program.

Choosing car insurance can be confusing. You have to think about things like how much it costs, what’s covered, and if the company is good. Many people get stressed trying to find the right plan. Luckily, there are programs that help! Compliant Drivers Program Car Insurance can be a great option, but you must choose wisely. You need to understand the details to get the best deal.

In this blog, we will help you understand Compliant Drivers Program Car Insurance. We will look at the pros and cons. You will learn what to look for and how to pick the best plan for you. Ready to find the right car insurance? Let’s get started!

Our Top 5 Compliant Drivers Program Car Insurance Recommendations at a Glance

Top 5 Compliant Drivers Program Car Insurance Detailed Reviews

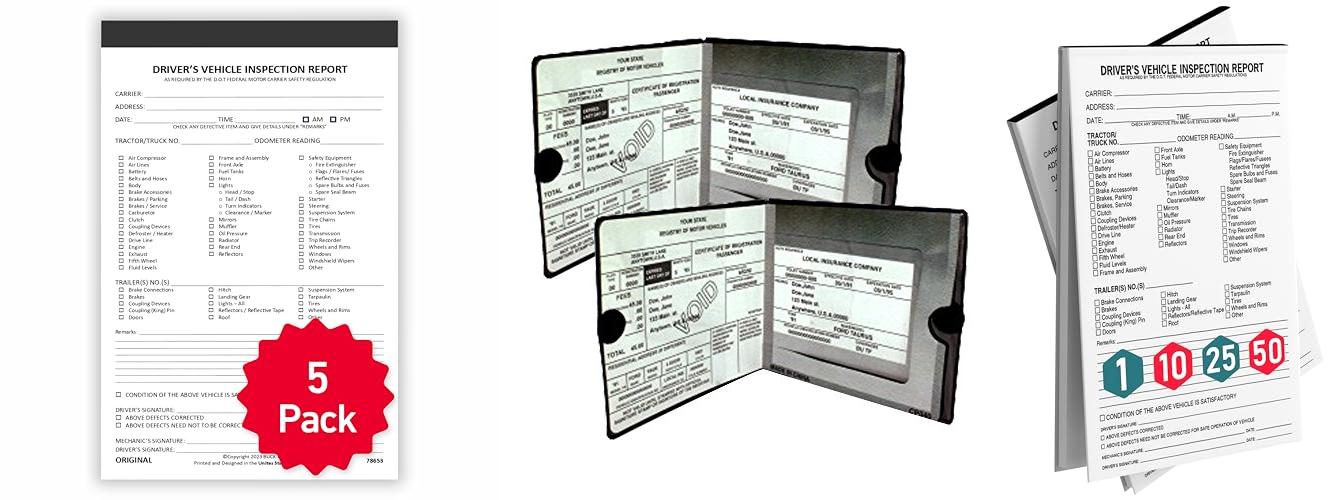

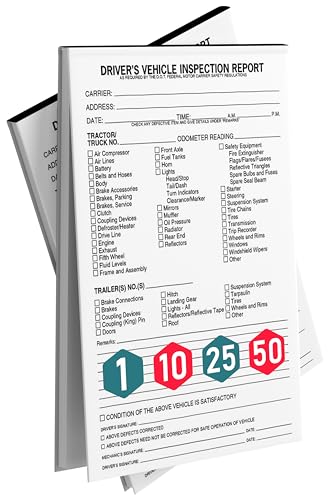

1. 5 Pack Detailed Driver Vehicle Inspection Report Book – 2-Ply Carbonless

Rating: 9.4/10

Stay compliant and keep your trucks safe with the 5 Pack Detailed Driver Vehicle Inspection Report Book. This handy book helps truck drivers and fleet managers. It makes daily vehicle inspections simple. This book is built to help you follow DOT rules. It includes a checklist and easy tear-out forms. Each book has 35 sets of forms. They are the right size for your needs.

What We Like:

- DOT Compliance Made Easy: You can easily follow DOT rules.

- Efficient Daily Inspections: The checklist helps drivers inspect their trucks quickly.

- DOT-Required Procedures at Your Fingertips: Important rules are printed inside the book.

- Durable and Convenient: The forms are strong. They are easy to handle and store.

- Perfect for Commercial Fleets: This book works well for any size fleet.

What Could Be Improved:

- None specified in the given information.

This DVIR book is a smart choice for truck drivers and fleet managers. It helps you stay safe and follow the law. This book makes your job easier.

2. ESSENTIAL Car Auto Insurance Registration BLACK Document Wallet Holders 2 Pack – [BUNDLE

Rating: 9.0/10

Keep your important vehicle documents safe and sound with the ESSENTIAL Car Auto Insurance Registration BLACK Document Wallet Holders! This handy 2-pack is a must-have for any vehicle owner. It works for cars, motorcycles, trucks, SUVs, and even boats. These black vinyl holders feature a clear window for easy viewing. They are water-resistant and protect your license, ID, insurance card, and registration. Strong velcro closures keep everything secure.

What We Like:

- The document holders work for many different vehicles.

- They protect your important papers from water.

- The clear window makes it easy to see your documents.

- The velcro closures keep everything safe.

- They are made of durable vinyl.

What Could Be Improved:

- The size might not fit all documents perfectly.

These document holders are a simple and effective way to protect your essential vehicle paperwork. They are a great value for the price.

3. 10 Pack Detailed Driver Vehicle Inspection Report Book

Rating: 9.1/10

The 10 Pack Detailed Driver Vehicle Inspection Report Book is a must-have for truck drivers. It helps them stay safe and follow the rules. This book has 38 sets of forms in each book. It is also 2-ply carbonless so it is easy to use. This book is designed to meet all the requirements for DOT inspections. This ensures drivers can quickly check their vehicles before each trip. It is perfect for keeping track of vehicle maintenance and safety.

What We Like:

- This DVIR book meets DOT rules, so drivers stay compliant.

- The pre-trip checklist helps drivers quickly check their trucks.

- The checklist follows FMCSR rules.

- These books help keep track of vehicle maintenance. This helps vehicles last longer.

- You get 10 books, each with many forms. This is great for daily use and record keeping.

What Could Be Improved:

- The size might be too small for some drivers.

- The paper quality could be better.

Overall, this DVIR book is a helpful tool for truck drivers. It makes inspections easier and helps with safety.

4. W4W

Rating: 8.5/10

Keep your important car documents safe and organized with the W4W Auto Registration, Insurance & ID Card Holder! This 4-pack is made for any vehicle: cars, trucks, motorcycles, trailers, and even boats. It has a strong Velcro closure to keep your documents secure. Men and women can use it. It’s the perfect way to avoid clutter and keep your papers neat.

What We Like:

- This 4-pack helps you organize your car papers.

- It fits in your visor or glove box easily.

- The holder protects your documents from wear and tear.

- It is waterproof to keep your papers safe.

- The Velcro closure keeps everything secure.

- You can easily read your documents inside.

- It has dividers to hold multiple items, even money.

- It’s a great gift for anyone with a car.

What Could Be Improved:

- Some users may find the size limiting if they have many documents.

The W4W Auto Registration, Insurance & ID Card Holder is a simple solution to car organization. It is a practical and useful accessory for any driver.

5. CoBak Car Registration and Insurance Holder – Vehicle Glove Box Car Organizer

Rating: 9.4/10

Keep your important car documents safe and easy to find with the CoBak Car Registration and Insurance Holder. This handy organizer fits right in your glove box. It’s made with nice PU leather and has a cool black woven pattern. It’s designed to hold your car registration, insurance papers, driver’s license, and other important cards. This little case helps you stay organized on the road.

What We Like:

- The holder is made from good quality PU leather.

- It has clear pockets so you can see your documents quickly.

- It has space for your car registration, insurance papers, and more.

- The size is perfect for your glove box or console.

- It’s built to last.

What Could Be Improved:

- The overall design is simple.

The CoBak Car Registration and Insurance Holder is a smart way to keep your car documents organized. You can easily find your important papers when you need them. This holder is a good choice for anyone who wants to stay organized in their car.

Driving with Confidence: Your Guide to Compliant Drivers Program Car Insurance

Are you looking for car insurance? If you are, you should know about the Compliant Drivers Program. This program helps drivers who may have had some trouble in the past. Maybe you have a few tickets or accidents. This guide will help you figure out if this insurance is right for you.

1. Key Features to Look For

The Compliant Drivers Program focuses on helping drivers. These are some things to look for:

- Coverage Options: Does the insurance cover what you need? You need to think about liability, collision, and comprehensive coverage. Liability pays for damage you cause to others. Collision covers damage to your car from accidents. Comprehensive covers other things like theft or weather damage.

- Accident Forgiveness: This is a big plus! Some plans forgive your first accident. This means your rates won’t go up after one accident.

- Roadside Assistance: This is helpful if you get a flat tire or run out of gas. Roadside assistance can help you out.

- Discounts: Do they offer discounts? You could get a discount for safe driving or having a good credit score.

2. Important Materials You Need

You will need to provide some information to get this insurance. This is what you’ll need:

- Your Driver’s License: You need a valid driver’s license.

- Vehicle Information: They will need your car’s make, model, and year.

- Driving History: Be ready to share your driving record. This includes any tickets or accidents you’ve had.

- Proof of Prior Insurance (If Applicable): If you had insurance before, provide proof. This helps them figure out your rates.

3. Factors That Improve or Reduce Quality

Some things can make the insurance better or worse. Here are some things to think about:

- Your Driving Record: The better your driving record, the better your rates will be. If you have tickets or accidents, your rates will likely be higher.

- Your Credit Score: Insurance companies often check your credit score. A good credit score can help you get lower rates.

- The Insurance Company’s Reputation: Check reviews about the insurance company. See what other people say about them.

- Customer Service: Good customer service is important. You want to be able to get help when you need it.

4. User Experience and Use Cases

The Compliant Drivers Program is designed for drivers who might have trouble getting insurance.

Use Case 1: A driver with a few speeding tickets. This program helps them get insurance at a reasonable price.

Use Case 2: Someone who has had an at-fault accident. This program might offer coverage even after an accident.

User Experience: The application process is usually pretty straightforward. You answer some questions and provide some documents. The goal is to get you covered quickly.

Frequently Asked Questions (FAQ)

Q: What is the Compliant Drivers Program?

A: It is car insurance for drivers who might have a less-than-perfect driving record.

Q: Who is this insurance for?

A: It is for drivers with tickets, accidents, or other issues that make it hard to get insurance.

Q: How do I get a quote?

A: You can get a quote online or by calling the insurance company.

Q: What kind of coverage can I get?

A: You can usually get liability, collision, and comprehensive coverage.

Q: Will my rates go up if I have an accident?

A: It depends. Some plans offer accident forgiveness. Your rates might not go up with that.

Q: Does this program offer discounts?

A: Yes, they might offer discounts for things like safe driving or a good credit score.

Q: What if I need to file a claim?

A: You will contact the insurance company to file a claim. They will guide you through the process.

Q: Can I pay my bill online?

A: Yes, most insurance companies let you pay your bill online.

Q: How long does it take to get approved?

A: It usually doesn’t take long. You can often get approved within a few days.

Q: Where can I find customer reviews?

A: You can find customer reviews online. Check websites that review insurance companies.

In conclusion, every product has unique features and benefits. We hope this review helps you decide if it meets your needs. An informed choice ensures the best experience.

If you have any questions or feedback, please share them in the comments. Your input helps everyone. Thank you for reading.

Hi, I’m Luigi Smith, the voice behind carrepairmag.com. As a passionate car enthusiast with years of hands-on experience in repairing and maintaining vehicles, I created this platform to share my knowledge and expertise. My goal is to empower car owners with practical advice, tips, and step-by-step guides to keep their vehicles running smoothly. Whether you’re a seasoned mechanic or a beginner looking to learn, carrepairmag.com is your go-to source for all things car repair!