Yes, it is possible to lose your house due to an at-fault car accident. If you cause a car accident and the resulting damages exceed your insurance coverage, you could be sued for the remaining amount. This judgment could potentially lead to a lien being placed on your property, and in some cases, even foreclosure. This article explores the risks involved when your house at risk car accident, how to protect yourself, and what to do if you face such a situation.

Image Source: www.blgwins.com

The Shocking Reality: Your Home Vulnerable After Car Crash

A car accident can turn your life upside down in an instant. Beyond the physical injuries and emotional trauma, there’s a significant financial risk, especially if you are at fault. While liability insurance exists to cover damages, it might not be enough in cases involving serious injuries or multiple vehicles. This can leave your personal assets, including your home, home vulnerable after car crash.

How a Car Accident Can Put Your Home in Danger

-

The Lawsuit: If the other party’s damages exceed your insurance limits, they can sue you for the remaining amount. This lawsuit seeks to recover medical bills, lost wages, property damage, and potentially pain and suffering.

-

The Judgment: If the court rules in favor of the plaintiff, they will be awarded a judgment. This judgment is a legal obligation for you to pay the specified amount.

-

The Lien: If you fail to pay the judgment, the plaintiff can obtain a lien against your property. A lien is a legal claim on your property that gives the creditor the right to seize and sell it to satisfy the debt.

-

Foreclosure: In extreme cases, if the judgment is substantial and you have no other assets to satisfy it, the creditor could initiate foreclosure proceedings to sell your home and recover the money owed.

Car Accident Lawsuit Home Equity: Why Your Home is a Target

Your home represents a significant portion of your net worth. The equity you’ve built in your home, the difference between its market value and the amount you owe on your mortgage, makes it an attractive target for creditors in a car accident lawsuit home equity.

Factors Increasing Your Risk

- High Net Worth: Individuals with significant assets are more likely to be sued, as there is a greater chance of recovering a substantial amount.

- Serious Injuries: Accidents resulting in severe injuries or fatalities often lead to higher settlements or judgments.

- Inadequate Insurance: Low liability coverage limits leave you exposed to personal liability if damages exceed those limits.

- Egregious Negligence: Actions like drunk driving or reckless speeding can increase the likelihood of a large judgment against you.

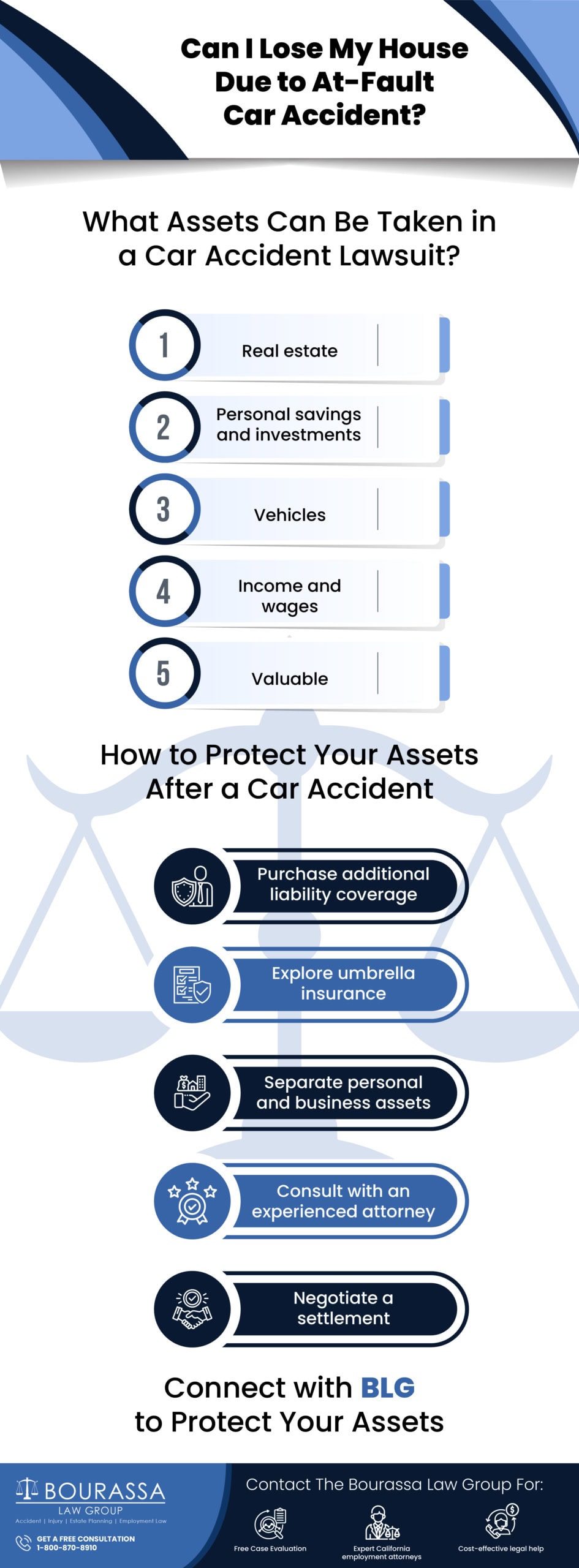

Protecting Assets After Car Accident: Fortifying Your Financial Fortress

While the risk of losing your home is real, there are steps you can take to protect your assets and minimize your exposure in the event of an at-fault car accident. Protecting assets after car accident involves a multi-faceted approach.

Increasing Your Liability Insurance Coverage

The most basic, yet often overlooked, step is to increase your liability insurance coverage. Aim for coverage limits that match or exceed your net worth.

| Coverage Level | Pros | Cons |

|---|---|---|

| State Minimum | Lowest cost option. | Offers minimal protection, leaving you highly vulnerable to personal liability. |

| $100,000/$300,000 | Provides a reasonable level of protection for many situations. | May still be insufficient for accidents involving serious injuries or multiple vehicles. |

| $250,000/$500,000 | Offers more comprehensive protection and peace of mind. | Higher premium costs. |

| $500,000/$1,000,000 | Provides the highest level of protection, ideal for individuals with significant assets. | Highest premium costs. |

Obtaining Umbrella Insurance

Umbrella insurance provides an extra layer of liability protection above and beyond your auto and homeowners insurance policies. It kicks in when your other policies are exhausted, offering millions of dollars in additional coverage.

Understanding Your State’s Homestead Exemption

Many states have homestead exemptions that protect a certain amount of equity in your primary residence from creditors. The amount of the exemption varies widely by state. Research your state’s homestead exemption to understand how much of your home equity is protected.

Using Legal Structures for Asset Protection

Consult with an attorney to explore advanced asset protection strategies, such as:

- Irrevocable Trusts: These trusts can shield assets from creditors but involve relinquishing control over those assets.

- Limited Liability Companies (LLCs): If you own rental properties, holding them in an LLC can protect your personal assets from liability related to those properties.

- Strategic Titling: How you title your property can affect its vulnerability to creditors. Joint ownership with rights of survivorship may offer some protection.

Maintaining Safe Driving Habits

The best way to protect your assets is to avoid causing accidents in the first place. Practice safe driving habits, avoid distractions, and never drive under the influence of alcohol or drugs.

Liability Car Accident Home Ownership: What Happens Next?

Even with precautions, accidents happen. If you are at fault in a car accident and face a lawsuit, here’s what to expect:

The Lawsuit Process

-

Complaint: The plaintiff files a complaint against you, outlining the details of the accident and the damages they are seeking.

-

Answer: You must file an answer to the complaint within a specified timeframe, responding to the allegations.

-

Discovery: Both sides gather evidence through interrogatories, depositions, and requests for documents.

-

Negotiation: Settlement negotiations may occur at any point during the process.

-

Trial: If a settlement cannot be reached, the case will proceed to trial.

What to Do If You Are Sued

- Contact Your Insurance Company Immediately: Your insurance company will provide a defense attorney to represent you.

- Cooperate with Your Attorney: Provide your attorney with all relevant information and documents.

- Consider Settlement: Settlement may be a more favorable option than going to trial, especially if the evidence against you is strong.

- Explore Payment Options: If a judgment is entered against you, explore options for paying it off, such as a payment plan.

Losing Home From Car Accident Debt: Facing the Worst-Case Scenario

If you are unable to pay a judgment and a lien is placed on your home, you face the risk of losing home from car accident debt.

Negotiating with the Creditor

Attempt to negotiate with the creditor to reach a settlement or payment plan. They may be willing to accept a lower amount than the full judgment to avoid the expense and hassle of foreclosure.

Filing for Bankruptcy

Bankruptcy is a legal process that can discharge certain debts, including judgments resulting from car accidents. Chapter 7 bankruptcy may allow you to discharge the debt entirely, while Chapter 13 bankruptcy involves a repayment plan. However, bankruptcy has serious consequences and should be considered carefully.

Defending Against Foreclosure

If the creditor initiates foreclosure proceedings, you have the right to defend yourself. Common defenses include:

- Challenging the Validity of the Lien: Arguing that the lien was improperly obtained or is invalid for some reason.

- Claiming the Homestead Exemption: Asserting your right to the homestead exemption to protect a portion of your home equity.

- Negotiating a Loan Modification: Working with your mortgage lender to modify your loan terms to make payments more affordable.

Car Accident Property Seizure: Beyond the Home

While your home is the most significant asset at risk, other property can also be subject to seizure to satisfy a judgment. Car accident property seizure can include vehicles, bank accounts, and personal property.

Protecting Other Assets

- Exempt Property: Many states have laws that exempt certain types of property from seizure, such as clothing, household goods, and tools of the trade.

- Retirement Accounts: Retirement accounts, such as 401(k)s and IRAs, are generally protected from creditors under federal law.

- Life Insurance: The cash value of life insurance policies may be protected in some states.

Home Foreclosure Car Accident Settlement: Can the Settlement Save Your Home?

If you receive a settlement from your own insurance company or another party involved in the accident, you may be able to use those funds to prevent home foreclosure car accident settlement.

Using Settlement Funds to Pay the Judgment

The most direct way to save your home is to use the settlement funds to pay off the judgment in full.

Negotiating with the Creditor

Even if the settlement is not enough to pay the entire judgment, you can use it as leverage to negotiate a settlement with the creditor. Offer to pay a portion of the debt in exchange for a release of the lien on your home.

Personal Injury Claim House Protection: Turning the Tables

If you are injured in a car accident caused by someone else, you may be able to file a personal injury claim to recover damages. A successful personal injury claim house protection may provide you with the funds to protect your own assets.

Pursuing a Claim Against the At-Fault Driver

Work with an attorney to pursue a claim against the at-fault driver’s insurance company. This claim can seek to recover medical expenses, lost wages, pain and suffering, and other damages.

Using Settlement Funds to Protect Your Assets

If you receive a settlement or judgment in your favor, you can use those funds to pay off debts, increase your insurance coverage, or implement other asset protection strategies.

Can a Car Accident Affect My House? Insurance Considerations

Many types of insurance can affect what happens to your home after a car accident, depending on whether you’re at fault or not. Understanding these insurance aspects is crucial. Can a car accident affect my house? Yes, and here’s how insurance plays a role:

Your Auto Insurance Liability Coverage

This is the primary protection if you cause an accident. It covers damages to the other party, up to your policy limits. Higher limits offer more protection for your assets.

Uninsured/Underinsured Motorist Coverage

If you’re hit by someone with no insurance or insufficient coverage, this pays for your injuries and damages. It doesn’t directly protect your home, but helps avoid a scenario where you have large unpaid medical bills and have to tap into your home equity.

Med-Pay or Personal Injury Protection (PIP)

These cover your medical expenses regardless of fault. Like uninsured/underinsured coverage, they mitigate the chances of you accumulating large debts that put your home at risk.

Homeowners Insurance

Typically doesn’t cover car accidents directly. However, if someone sues you and your auto policy isn’t enough, your homeowner’s insurance might offer some liability coverage as a secondary layer, depending on the specifics of the accident and policy.

Umbrella Insurance – The Ultimate Safety Net

This provides excess liability coverage above your auto and homeowners policies. It’s the most robust way to safeguard your assets, including your home, from large judgments.

Final Thoughts: Guarding Your Home

Losing your home due to a car accident is a frightening prospect, but it is preventable. By taking proactive steps to protect your assets, such as increasing your insurance coverage, utilizing legal structures, and practicing safe driving habits, you can significantly reduce your risk. If you are involved in an accident, seek legal advice immediately to understand your rights and options.

Frequently Asked Questions (FAQ)

Q: Can I lose my house if someone sues me after a car accident?

A: Yes, if you are found liable and the damages exceed your insurance coverage, the injured party can sue you. If they win a judgment, they can place a lien on your property, potentially leading to foreclosure.

Q: How much liability insurance should I carry to protect my home?

A: It’s best to carry liability insurance that matches or exceeds your net worth. Consult with an insurance professional to determine the appropriate coverage limits for your situation.

Q: What is a homestead exemption, and how can it protect my home?

A: A homestead exemption protects a certain amount of equity in your primary residence from creditors. The amount of the exemption varies by state. Research your state’s laws to understand the specific protections available to you.

Q: Is umbrella insurance worth the cost?

A: For individuals with significant assets, umbrella insurance is highly recommended. It provides an extra layer of liability protection that can safeguard your assets from large judgments.

Q: What should I do immediately after a car accident?

A: Ensure your safety and the safety of others involved. Call the police to report the accident, exchange information with the other driver, and gather evidence, such as photos and witness statements. Contact your insurance company as soon as possible.

Q: Can bankruptcy protect my home from a car accident judgment?

A: Yes, bankruptcy can potentially discharge a car accident judgment, but it has significant consequences and should be considered carefully. Consult with a bankruptcy attorney to explore your options.

Q: If I’m being sued after a car accident, should I hire my own attorney, or will the insurance company’s attorney be sufficient?

A: While the insurance company will provide an attorney to defend you, it’s advisable to consult with your own attorney as well. This ensures that your interests are fully represented, especially if the damages exceed your insurance coverage.

Q: What are some common asset protection strategies besides insurance?

A: Common strategies include using irrevocable trusts, LLCs for rental properties, and strategic titling of assets. Consult with an attorney to determine the best strategies for your specific situation.

Hi, I’m Luigi Smith, the voice behind carrepairmag.com. As a passionate car enthusiast with years of hands-on experience in repairing and maintaining vehicles, I created this platform to share my knowledge and expertise. My goal is to empower car owners with practical advice, tips, and step-by-step guides to keep their vehicles running smoothly. Whether you’re a seasoned mechanic or a beginner looking to learn, carrepairmag.com is your go-to source for all things car repair!